In our earlier article, we discussed about the concept of Behavioural Finance and few biases that involuntarily govern an investors’ decisions. Few more biases that exist are:

Regret Aversion Bias

Regret Aversion is a psychological error that arises out of excessive focus on feelings of regret at having made a decision, which turned out to be poor, mainly because the outcomes of the alternative are visibly better for the investor to see. The root cause of this type of error is the tendency that individuals hate to admit their mistakes. Because of suffering from this bias, investors may avoid taking decisive actions for the fear that whatever decisions they make take will be sub-optimal in Hindsight. One potential downside is that this could lead investors into holding onto a losing position for too long, because of unwillingness to admit and rectify mistakes in a timely manner. Another downside is that it can stop investors from making an entry into the market when there has been a downtrend, which is showing signs of ending, and signals that it is a good time to buy. People who are regret averse tend to avoid distress arising out of two types of mistakes

- Errors of commission – which occur as a result of misguided action, where the investor reflects on this decision and rues the fact that he made it, thus questioning his beliefs

- Errors of omission – which occur as a result of missing an opportunity which existed

Gamblers’ Fallacy Bias

Gamblers’ Fallacy arises when investors inappropriately predict that trend will reverse and are drawn into contrarian thinking. Gamblers’ Fallacy is said to occur when an investor operates under the perception that errors in random events are self-correcting. For instance, if a fair coin is tossed ten times and it land on heads each time, an investor who feels that the next flip will result in tails (even though the probability of occurrence heads or tails is still 50%) can be said to be suffering from this bias.

Mental Accounting Bias

Mental Accounting is the set of cognitive operations used by individuals and households to organize, evaluate, and keep track of financial activities. This result in a tendency for people to separate their money into separate accounts based on a variety of subjective reasons (say child’s education, marriage, vacation home, etc). Individuals tend to assign different functions to each asset group, which has an often irrational and negative effect on their consumption decisions and other behaviours. Mental Accounting refers to the codes people use when evaluating an investment decision. For example, people often have a special “money jar” or fund set aside for a vacation or a new home, while still carrying substantial credit card debt.

Hindsight Bias

Also known as the knew-it-all-along effect or creeping determinism is the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it. For example, an investor may look at the sudden and unforeseen death of an important CEO as something that should have been expected since the CEO was likely to be under a lot of stress.

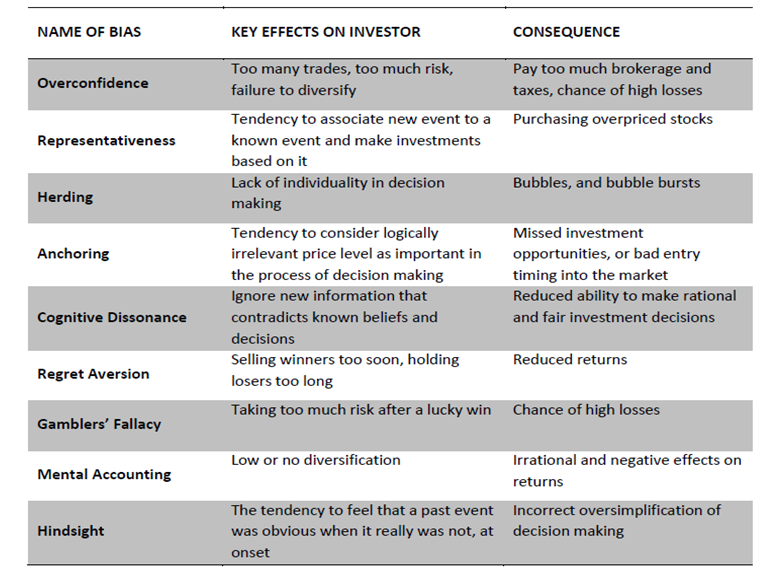

A Summary of the Effects and Consequences of all the Biases

FRAME DEPENDENCE

Frame dependence implies that individuals make decisions and take actions according to the framework within which the information is received (i.e., the media) or the individual’s circumstances (i.e., emotional state) at the time. If investors acted with frame independence, they would make purely economic decisions and base each decision purely on its expected merits.

Behavioural characteristics that can be attributed to frame dependence include loss aversion, self control, regret minimisation and money illusion.

Loss Aversion

Loss aversion refers to individual’s reluctance to accept a loss. A stock may be down considerably from its purchase price, but the investor holds on to it, hoping that it will recover.

This can also lead to risk-seeking behaviour. A portfolio manager, for example, may have experienced recent losses. Knowing that he must report at the end of the quarter and being reluctant to report losses, he might start taking progressively riskier positions in hopes of at least breaking even.

Self Control

Self control is defined as ‘controlling one’s emotions’. A younger, affluent investor may totally avoid high dividend paying stocks because of the related tax consequences and the effect on the overall portfolio return. However, a retired investor might use dividends as a self-imposed control mechanism to avoid spending the capital in his retirement account. In his mind he has framed that dividend is very important. So if a stock doesn’t pay dividend it is not an optimal investment for him.

Regret Minimisation

Regret is a feeling, in hindsight, associated with making a bad decision. For example, an investor sells a winning stock and then watches it soar even higher. The investor immediately starts regretting his decision and wishes he had held on to it a little longer. The same is true for holding on to a stock which keeps falling. He wishes he had sold them earlier.

Regret minimisation can lead to two common situations.

- To avoid the feeling of regret, investors choose comfortable investments resulting in lack of variety in investments.

- Rather than selling profitable investments, investors may tend to use their cash flows, such as interest payments and dividends, for living expenses.

Money Illusion

Money illusion refers to the way individuals react to inflation and its impact on investment performance. People tend to think naturally in nominal terms. They look at the overall investment return without regard for the level of inflation and the resulting real return. This leads to positive reactions to high returns no matter what the level of inflation.

Whether it”s mental accounting, irrelevant anchoring, just following the herd or any frame dependence, chances are we”ve all been guilty of at least some of the biases and irrational behaviour. Now that we can identify some of the biases, it”s time to apply that knowledge to our own investing and if need be take corrective action. Hopefully, our future financial decisions will be a bit more rational and lot more lucrative.